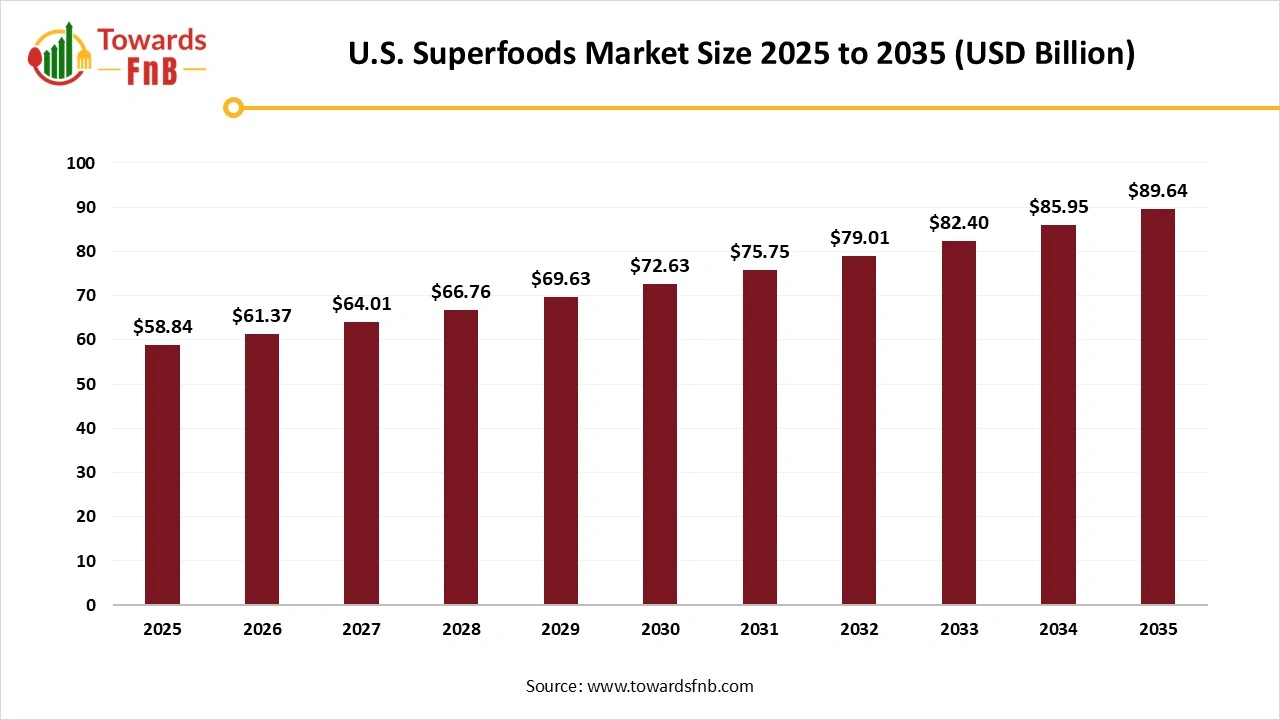

Ottawa, Jan. 07, 2026 (GLOBE NEWSWIRE) -- The U.S. superfoods market size stood at USD 58.84 billion in 2025 and is predicted to grow from USD 61.37 billion in 2026 to reach around USD 89.64 billion by 2035, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is observed to grow due to the rising prevalence of chronic diseases and lifestyle-related health issues. The health-conscious growing population of the region is also one of the major factors in the growth of the market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5581

Key Highlights of the U.S. Superfoods Market

- By type, the fruits segment accounted for the largest market share of 29% in 2025, supported by growing consumer preference for fruit-based products that help manage age-related concerns while promoting overall vitality and wellness.

- By type, the grains and seeds segment is projected to register the fastest growth over the forecast period, fueled by increasing awareness of their benefits in supporting hormonal balance and enhancing overall health.

- By application, the beverages segment led the market in 2025, driven by rising demand for functional beverages and energy drinks among consumers in the U.S.

- By application, the snacks segment is anticipated to grow at the fastest pace during the forecast period, owing to higher consumption of nutrient-rich nuts and fresh fruits that support immunity and healthy lifestyles.

- By distribution channel, the offline segment held the dominant market share in 2025, attributed to consumer trust in physical retail formats and the ease of direct, in-person purchasing and communication.

- By distribution channel, the online segment is expected to witness rapid growth, supported by technological advancements and digital tools that enable seamless transactions and real-time business monitoring.

Higher Health Advantages are helpful for the Growth of the U.S. Superfoods Industry

The U.S. superfoods market is expected to grow due to the growing population of health-conscious consumers, leading to higher demand for functional, clean-label, and organic options. Superfoods are also ideal to promote weight loss, as they help to lower cravings, keep one satiated, and avoid munching on junk snacks. They are also ideal for the management of lifestyle-related health issues such as diabetes, cholesterol, and cardiovascular issues. These are also easily available on various platforms in the region, helpful for consumers to maintain their nutritional profile and avoid munching on junk snacks. Superfoods help to manage physical as well as mental issues, further propelling the market’s growth.

New Trends of the U.S. Superfoods Market

- Higher consumer awareness of gut health in the region, leading to higher demand for superfood options such as spices, vegetables, and fruits, helps to fuel the growth of the market.

- The growing population of health-conscious consumers, fueling the demand for different types of superfoods such as seeds, nuts, and grains, helps to fuel the market’s growth.

- Prioritizing brain health by consumers in the region, leading to higher demand for superfoods such as seeds, nuts, and dark greens, also helps to fuel the market’s growth.

Impact of AI in the U.S. superfoods market

Artificial intelligence (AI) is influencing the U.S. superfoods market by improving ingredient validation, formulation accuracy, supply chain planning, and alignment with health-driven consumer demand. In product development, AI systems analyze nutritional composition data, bioactive compound research, and dietary intake patterns to help manufacturers identify superfoods with specific functional benefits. These include antioxidants from berries, omega fatty acids from seeds, polyphenols from cacao and green tea, and micronutrients from leafy greens and algae. AI models evaluate how these ingredients behave in powders, snacks, beverages, and supplements, helping developers preserve nutrient density while maintaining taste and stability.

In sourcing and agriculture, AI tools process data from soil analysis, weather trends, and yield reports to support a consistent supply of superfood crops such as blueberries, chia, flaxseed, kale, and spirulina. These insights help suppliers reduce variability caused by seasonal shifts and regional growing conditions. For imported superfoods, AI assists in supplier risk assessment and traceability, which is important for meeting U.S. food safety and labeling requirements.

Manufacturing operations benefit from AI-driven process control that monitors drying temperatures, particle size, moisture levels, and oxidation risk. Machine learning models adjust processing conditions to reduce nutrient loss during dehydration, milling, or extraction. Quality assurance systems supported by AI use spectroscopy and imaging to detect adulteration, contamination, or potency deviations, which is critical in a category often challenged by inconsistent standards.

AI also strengthens demand forecasting and inventory planning by analyzing retail sales, e-commerce trends, and health-related search behavior across U.S. consumers. These tools help brands align production with interest in immune support, gut health, plant-based diets, and clean-label foods.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/us-superfoods-market

Recent Developments in U.S. Superfoods Market

- In June 2025, Café Delhi Heights teamed up with American Pecans to launch the ‘American Pecans Superfoods Festival.’ The festival was from 15th June to 15th July 2025, across all the Café Delhi Heights outlets in India. The menu of the festival was curated by renowned nutritionist Kavita Devgan, highlighting the benefits of pecans and their rich flavors blending with the Indian palate.

- In March 2025, eatThis Superfood officially announced the launch of its new line of roasted foxnuts in the U.S. The brand produces nutrient-rich and unique-flavored snacks. The new launch involves flavors such as BBQ, sea salt caramel, and chili.

U.S. Superfoods Market Dynamics

What Are the Growth Drivers of U.S. Superfoods Market?

The rising health and wellness trends due to the growing health-conscious population of the region are one of the major factors for the growth of the market. Hence, it leads to higher demand for functional, clean-label, and organic options. Such food options aid in managing lifestyle-related and chronic health issues such as diabetes, cholesterol, heart issues, and mental issues as well. Easy availability of superfoods in the US on various online and offline platforms is also one of the major factors for the growth of the market. Superfoods are also healthy for mental well-being, further fueling their higher demand along with the growth of the market.

Issues in Industrial Processing and Production Are Hampering the Market’s Growth

Researchers and production units in the US face issues in the production, distribution, and sales procedures of the superfoods, hampering the market’s growth. Maintaining sustainability during the production procedure of superfoods, along with higher production, is another major challenge obstructing the market’s growth. Enhancing the quality of the produce without excess cost is another major factor restraining the market’s growth.

Diverse Applications aiding Market’s Growth

Superfoods useful for different types of health issues are one of the major factors for the growth of the U.S. superfoods market. Different types of superfoods with different health benefits help propel the market’s growth. Seeds and nuts for brain development, cheese for mental wellbeing, and fox nuts for weight management are some of the advantages of superfoods fueling the growth of the market. They are also helpful in managing weight, cell repair, and other similar lifestyle-related issues.

Higher Investments and Funding Help to Fuel the Market’s Growth

Higher funds and investments are one of the major factors helpful for the growth of the U.S. superfoods market. The funds provided by the USDA support efforts across the Community Food Projects Competitive Grants Program (CFPCGP) and NIFA. The USDA is helpful in focusing on America’s resilient, local, and regional food production, which helps propel the market’s growth. Ensuring the safety, health, and nutrition of such food options by the community is another factor helpful for the market’s growth. Higher investments also help to create work opportunities for farmers and producers to build new markets and help to enhance the market’s growth.

Product Survey of the U.S. Superfoods Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or Consumer Segments | Representative Brands or Product Types (U.S.) |

| Berry-Based Superfoods | Fruits rich in antioxidants, polyphenols, and vitamins. | Fresh berries, freeze-dried powders, extracts | Smoothies, supplements, snacks, cereals | Navitas Organics, Sambazon, Nature’s Path |

| Leafy Green Superfoods | Nutrient-dense greens high in vitamins, minerals, and chlorophyll. | Kale powder, spinach powder, moringa powder | Green powders, functional beverages, supplements | Amazing Grass, Garden of Life |

| Seed-Based Superfoods | Seeds providing omega fatty acids, fiber, and plant protein. | Chia seeds, flaxseeds, hemp seeds | Baking, smoothies, cereals, nutrition bars | Nutiva, Manitoba Harvest |

| Ancient Grains and Pseudo-Cereals | Whole grains with high fiber and micronutrient density. | Quinoa, amaranth, millet, teff | Grain bowls, gluten-free foods, cereals | Bob’s Red Mill, Ancient Harvest |

| Marine Superfoods | Ocean-derived foods rich in omega-3s and trace minerals. | Spirulina powder, chlorella tablets, kelp flakes | Supplements, smoothies, functional foods | Nutrex Hawaii, EnergyBits |

| Root and Tuber Superfoods | Roots offering adaptogenic or anti-inflammatory properties. | Turmeric powder, ginger powder, maca powder | Supplements, teas, functional beverages | Gaia Herbs, Navitas Organics |

| Cacao and Cocoa Superfoods | Minimally processed cacao with flavanols and minerals. | Raw cacao powder, cacao nibs | Baking, snacks, smoothies | Navitas Organics, Viva Naturals |

| Superfood Powders and Blends | Multi-ingredient blends targeting wellness benefits. | Greens blends, reds blends, immunity blends | Daily nutrition drinks, supplements | Athletic Greens (AG1), Orgain |

| Functional Mushroom Superfoods | Mushrooms with immune and cognitive support benefits. | Reishi powder, lion’s mane capsules, chaga extracts | Supplements, coffee blends | Four Sigmatic, Host Defense |

| Fermented Superfoods | Foods enhanced through fermentation for gut health. | Kombucha, kefir, fermented greens powders | Functional beverages, digestive health | GT’s Living Foods, Health-Ade |

| Nut and Fruit Superfood Snacks | Snacks incorporating nutrient-dense ingredients. | Superfood trail mixes, fruit bars | On-the-go snacking, wellness consumers | KIND, That’s it. |

| Superfood Oils | Oils rich in antioxidants and healthy fats. | Avocado oil, coconut oil, black seed oil | Cooking, supplements, functional foods | Chosen Foods, La Tourangelle |

| Superfood Beverages | Ready-to-drink products featuring superfood ingredients. | Cold-pressed juices, superfood waters | Convenience retail, wellness beverages | Suja Life, Harmless Harvest |

| Superfood Supplements | Concentrated superfoods in capsule or tablet form. | Spirulina tablets, turmeric capsules | Dietary supplements | Nature Made, Gaia Herbs |

| Organic and Clean Label Superfoods | Superfoods produced with organic certification and minimal processing. | Organic powders, whole foods | Natural and organic food retail | Whole Foods private label, Thrive Market |

| Plant-Based Protein Superfoods | High-protein superfoods used for nutrition enhancement. | Pea protein, hemp protein powders | Sports nutrition, meal replacements | Orgain, Vega |

| Upcycled Superfood Ingredients | Superfoods derived from food processing byproducts. | Cacao fiber, fruit pulp powders | Sustainable foods, functional snacks | ReGrained, Renewal Mill |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5581

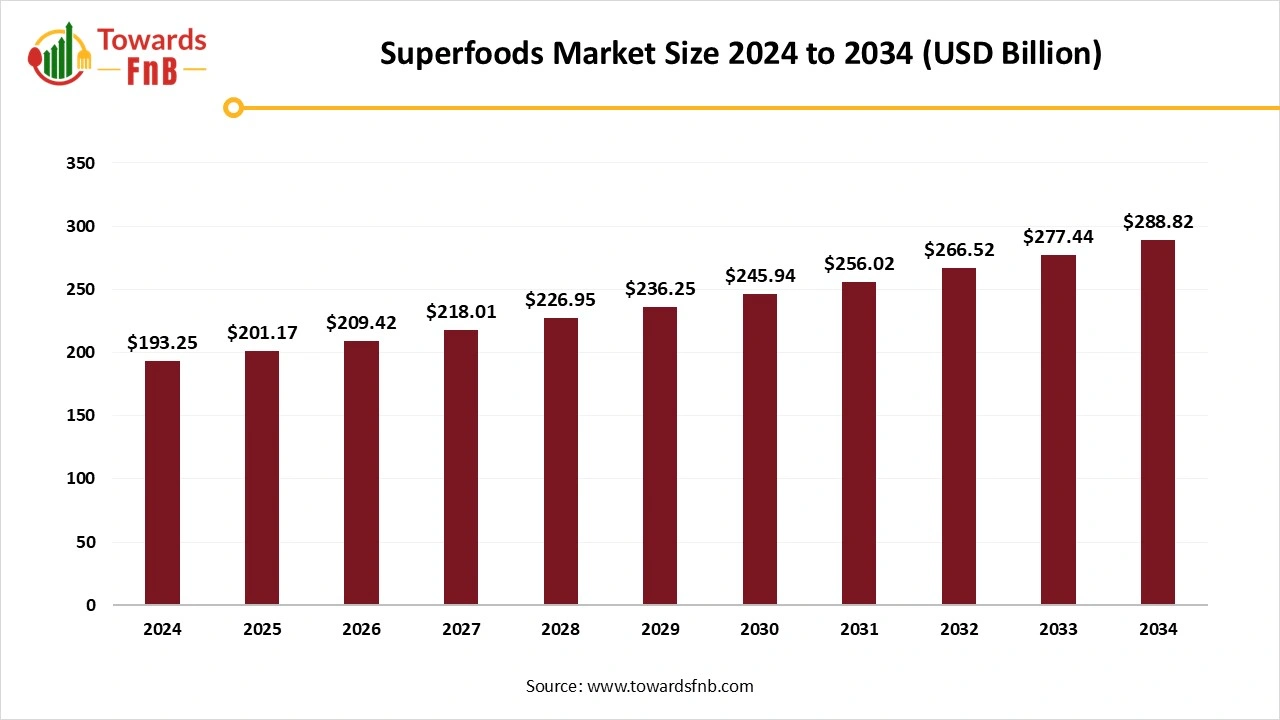

How Big is the Global Superfoods Market?

The global superfoods market reached a valuation of USD 193.25 billion in 2024 and is projected to grow to USD 288.82 billion by 2034, reflecting a CAGR of 4.1% during the forecast period. This robust growth is driven by the increasing consumer preference for plant-based, natural, and nutrient-dense foods that promote overall wellness, immunity, and a balanced lifestyle.

Regional Insights for the U.S. Superfoods Market

The United States superfoods market is shaped by strong regional consumption patterns, agricultural diversity, and high consumer awareness around health, nutrition, and preventive wellness. Demand is driven by functional benefits such as immunity support, gut health, heart health, and clean-label nutrition, with clear regional variations in product preference and distribution channels.

The West Coast represents one of the most mature and innovation-led markets for superfoods. High adoption of plant-based diets, organic products, and functional food drives strong demand for items such as chia seeds, quinoa, blueberries, avocados, spirulina, and turmeric. California plays a dual role as both a major producer and consumer, supported by extensive organic farming, wellness-oriented retail chains, and food innovation hubs. The region also leads in superfood-based beverages, smoothie, and nutraceutical formulations.

The Northeast shows strong demand for premium, convenience-focused superfoods integrated into packaged food, ready-to-drink beverages, and supplements. Urban consumers prioritize antioxidant-rich berries, seeds, and functional blends that support heart health, cognitive performance, and energy. High penetration of specialty health retailers, e-commerce platforms, and functional food startups supports market growth, particularly among working professionals and aging populations.

The Midwest market is driven by mainstream adoption of superfoods incorporated into everyday food products such as cereals, bakery items, snacks, and dairy alternatives. Consumers in this region show increasing interest in affordability, protein enrichment, and digestive health benefits. Locally grown superfoods such as oats, flaxseed, and pulses play a significant role, supported by strong agricultural supply chains and food processing infrastructure.

Trade Analysis for the U.S. Superfoods Market

What Is Actually Traded (Product Forms and HS Proxies)

- Fresh and frozen berries, leafy greens, and specialty fruits, typically classified under HS 0811 and HS 0810 depending on processing state.

- Dried superfoods such as berries, seeds, and botanicals are supplied in bulk, commonly declared under HS 0813 and HS 1204 for flax and similar seeds.

- Superfood powders and milled ingredients are used in smoothies, bars, and supplements, often classified under HS 1106 or HS 2106 depending on formulation.

- Extracts and concentrates such as turmeric, ginger, and botanical superfood extracts are typically classified under HS 1302.

Top Exporters (Supply Hubs)

- Canada: Major supplier of berries, flaxseed, and pulse-based superfoods to the U.S., supported by proximity, large-scale agriculture, and integrated logistics.

- Mexico: Key exporter of fresh and frozen berries, avocados, and leafy greens used in superfood positioning, benefiting from year-round production and trade integration.

- Peru and Chile: Exporters of berries, ancient grains, and botanicals such as quinoa and acai for U.S. food and supplement markets.

- India: Exporter of turmeric, ginger, and botanical superfood extracts used in supplements and functional foods.

Top Importers (Demand Centres)

- United States: The primary demand center, importing raw superfoods and processed ingredients to support domestic food manufacturing, supplement production, and retail consumption.

- U.S. food manufacturing hubs: California, Texas, and the Midwest act as internal redistribution centers where imported superfoods are processed, blended, and repackaged.

- U.S. supplement and beverage producers: Concentrated demand from nutraceutical and functional beverage manufacturers sourcing global superfood inputs.

Typical Trade Flows and Logistics Patterns

- Fresh superfoods such as berries and leafy greens move from Mexico and Canada to the U.S. under refrigerated truck and rail logistics.

- Frozen fruits and vegetables are shipped via containerized cold chain from South America and Asia to U.S. ports.

- Dried seeds, powders, and extracts move via containerized sea freight, often entering through West Coast and Gulf ports before inland distribution.

- Repacking and blending facilities in the U.S. convert imported raw materials into consumer-ready powders, mixes, and finished products.

Trade Drivers and Structural Factors

- Health and wellness consumption: Continued consumer focus on nutrient-dense foods supports sustained import demand.

- Limited domestic production: Certain superfoods such as acai, turmeric, and chia rely heavily on imports.

- Clean-label and plant-based trends: Increased use of whole-food ingredients in formulations drives demand for identifiable superfoods.

- Seasonality: Imports offset domestic production gaps and ensure year-round availability.

- Processing capability: The U.S. advantage lies in blending, packaging, and brand-led value addition rather than raw cultivation.

Regulatory, Quality and Market-Access Considerations

- Imported superfoods must comply with U.S. FDA food-safety regulations, including FSMA preventive controls.

- Botanical extracts and powders require contaminant, pesticide-residue, and heavy-metal testing.

- Labeling requirements affect nutrient claims, antioxidant positioning, and origin statements.

- Organic certification and non-GMO verification are frequently required by U.S. buyers.

Government Initiatives and Public-Policy Influences

- USDA import inspection and phytosanitary controls govern fresh and frozen superfood imports.

- FDA FSMA implementation continues to shape supplier qualification and traceability requirements.

- U.S. dietary guideline emphasis on fruits, vegetables, and whole grains indirectly supports superfood demand.

U.S. Superfoods Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 4.3% |

| Market Size in 2026 | USD 61.37 Billion |

| Market Size in 2027 | USD 64.01 Billion |

| Market Size in 2030 | USD 72.63 Billion |

| Market Size by 2035 | USD 89.64 Billion |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

U.S. Superfoods Market Segmental Analysis

Type Analysis

The fruit segment led the U.S. superfoods market in 2025, due to its higher consumption by consumers of different age groups. Researchers suggest that fruits help to aid a healthy mental wellbeing and help to avoid mental issues such as depression, insomnia, mood swings, and other similar mental issues. They are also a healthy substitute for junk and oil snack options, further fueling the growth of the market.

The grains and seeds segment is expected to grow in the foreseen period due to its higher demand by the growing population of health-conscious consumers of the region. Grains and seeds are highly nutritious and preferred by the health-conscious, vegan, and vegetarian crowd, further fueling the growth of the market. They also help to manage different types of lifestyle-related health issues such as diabetes, obesity, and various other health problems.

Application Analysis

The beverages segment dominated the U.S. superfoods market in 2025, due to high demand for functional beverages in the region by consumers of different age groups. Such beverages are also available in no-sugar and low-sugar options, further fueling the growth of the market. Such beverages are an ideal replacement for sugary and high-calorie drink options, further fueling the market’s growth. They also help boost mood and help stay calm and relaxed.

The snacks segment is expected to grow in the foreseeable period due to its higher demand by the consumers of the region. Healthy snacks are one of the best replacements for sugary, oily, spicy, and unhealthy options, helpful to fuel the market’s growth in the foreseeable period. They help to avoid munching on extra calories and are perfect to avoid overeating in the time duration between two meals. Hence, the segment has a major contribution to the growth of the U.S. superfoods market in the foreseeable period. Snacks such as fresh fruits, seeds and nuts, muesli, and various similar options are ideal replacements for unhealthy snacks.

Distribution Channel Analysis

The offline segment led the U.S. superfoods market in 2025 due to its easy approach, allowing consumers to get the right option at the right time. The segment involves different types of stores, allowing consumers to choose the right product from the right section of the store, further fueling the market’s growth. Such platforms are convenient and opportunistic, propelling the growth of the market.

The online segment is expected to grow in the foreseen period due to convenient factors such as technological advancements, real-time monitoring, and various other technological advancements for business. The convenience provided by the platform, allowing consumers to choose the desired product at a discounted price and get it delivered at their doorstep without stepping out of the house, is another major factor for the growth of the U.S. superfoods market in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Dietary Supplements Market: The global dietary supplements market size is projected to reach USD 507.33 billion by 2035, growing from USD 229.77 billion in 2026, at a CAGR of 9.2% from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Top Companies of the U.S. Superfoods Market

- Navitas Organics: A leading U.S. brand offering organic superfoods such as powders, seeds, cacao, and functional blends. Its emphasis on sustainability, certification, and clean-label transparency strengthens consumer trust and drives premium category growth.

- Sunfood Superfoods: Specializes in raw and minimally processed superfoods including powders, snacks, and specialty ingredients for wellness-focused consumers. The company fuels innovation in functional blends and high-potency nutrition products.

- Suncore Foods Inc.: Produces colorful, plant-based superfood powders from fruits, vegetables, and botanicals, combining functional benefits with visual appeal. Supports differentiation in beverages, bakery, and dessert formulations across retail and foodservice.

- Nestlé SA: Integrates superfood ingredients into its broad portfolio of nutrition, health science, and functional food products. Its global scale, R&D capabilities, and distribution network accelerate mainstream adoption of superfoods.

- Del Monte Foods: Leverages its fruit and vegetable portfolio to position superfoods in packaged, canned, and ready-to-eat foods. This approach increases accessibility and affordability, reaching consumers beyond niche health segments.

- General Mills Inc.: Incorporates superfood ingredients into cereals, snacks, and functional foods for health-conscious households. Its strong brands and retail reach drive large-scale adoption of superfoods in breakfast and snacking categories.

- Archer Daniels Midland Company (ADM): Supplies superfood-derived ingredients like plant proteins, fibers, oils, and botanical extracts to manufacturers. ADM enables scalable sourcing, formulation efficiency, and innovation for the superfoods market.

- Bulk Superfoods: Focuses on bulk-format superfood powders, seeds, and blends for B2B buyers and cost-sensitive consumers. Improves market accessibility and facilitates private-label and foodservice applications.

- Four Sigmatic: A leader in functional mushroom-based superfoods with coffees, beverages, and supplements for immunity, stress, and cognitive support. Significantly expands consumer awareness and demand for mushroom-based nutrition.

- Aloha: Produces plant-based protein powders, bars, and ready-to-drink products enriched with superfoods. Bridges sports nutrition and wellness segments, driving clean-label adoption and cross-category growth.

- SuperNutrients: Offers concentrated superfood blends and supplements for daily nutrition and functional wellness. Contributes to product diversity in the supplements segment with convenient, nutrient-dense formats.

Segments Covered in the Report

By Type

- Fruits

- Vegetables

- Grains and Seeds

- Herbs and Roots

- Others

By Application

- Snacks

- Beverages

- Bakery and Confectionery

- Others

By Distribution Channel

- Offline

- Online

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5581

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market